30+ Online depreciation calculator

Our car depreciation calculator uses the following values source. It provides a couple different methods of depreciation.

Category Insights Mercer Capital

This depreciation calculator is for calculating the depreciation schedule of an asset.

. Adheres to IRS Pub. The fundamental way to calculate depreciation is to take the assets price. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

There are three methods to calculate depreciation - the straight line depreciation the declining balance depreciation and the sum of years digits depreciation. The Depreciation Calculators are completely free for anyone to use and we hope that they provide the user with all of their needs. Percentage Declining Balance Depreciation Calculator.

The underlying assumption of this. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

For example if you have. After a year your cars value decreases to 81 of the initial value. Free MACRS depreciation calculator with schedules.

The Depreciation Calculator computes the value of an item based its age and replacement value. The formula for calculating. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Straight Line Depreciation Rate Straight Line DepreciationCost of Asset x 100.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Also includes a specialized real estate property calculator. Straight Line Depreciation Cost of Asset Scrap ValueUseful life.

The depreciation method is a way to spread out the cost of a long-term business asset over several years. After two years your cars value. If you have any questions about how they work or even.

Periodic straight line depreciation Asset cost - Salvage value Useful life. You can browse through general categories of items or begin with a keyword search. First one can choose the straight line method of.

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

Cade Ex991 149 Pptx Htm

11 Real Ways To Increase Your Income In 30 Days Or Less

Ecommerce Accounting Income Statements P L 101 Amaka

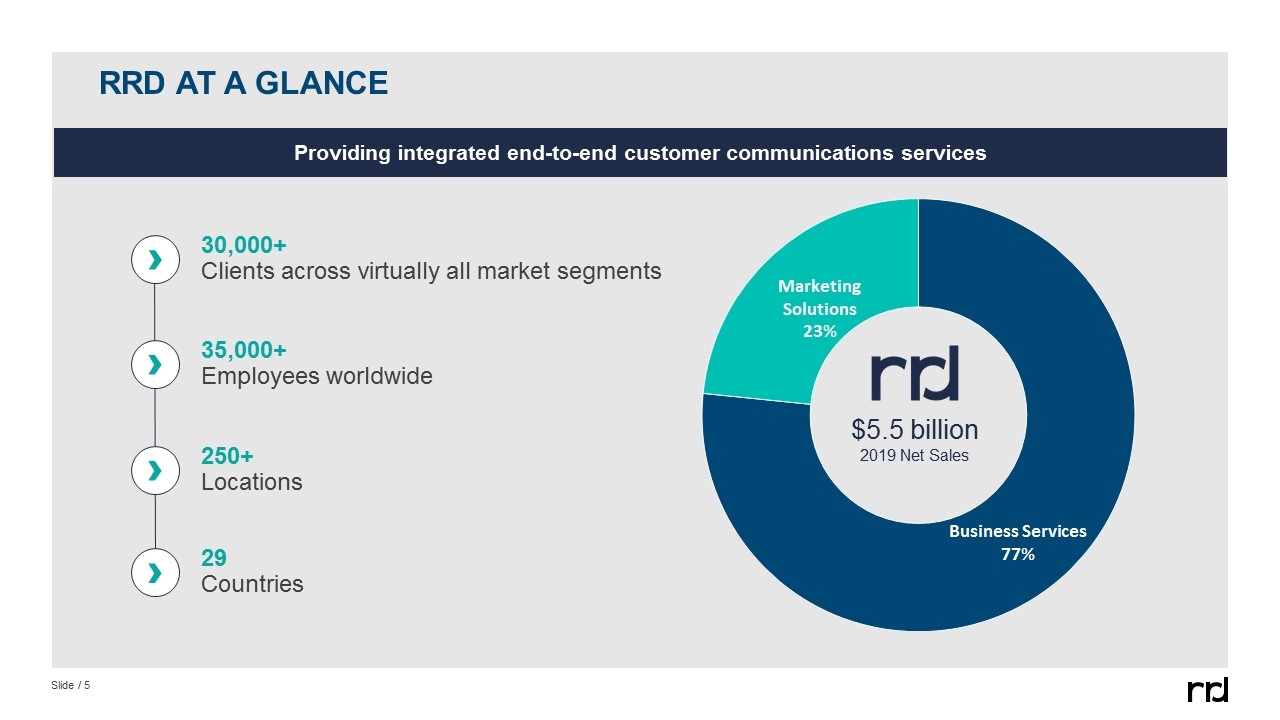

Rrd Ex991 251 Pptx Htm

Macrs Depreciation Calculator Based On Irs Publication 946

Rrd Ex991 251 Pptx Htm

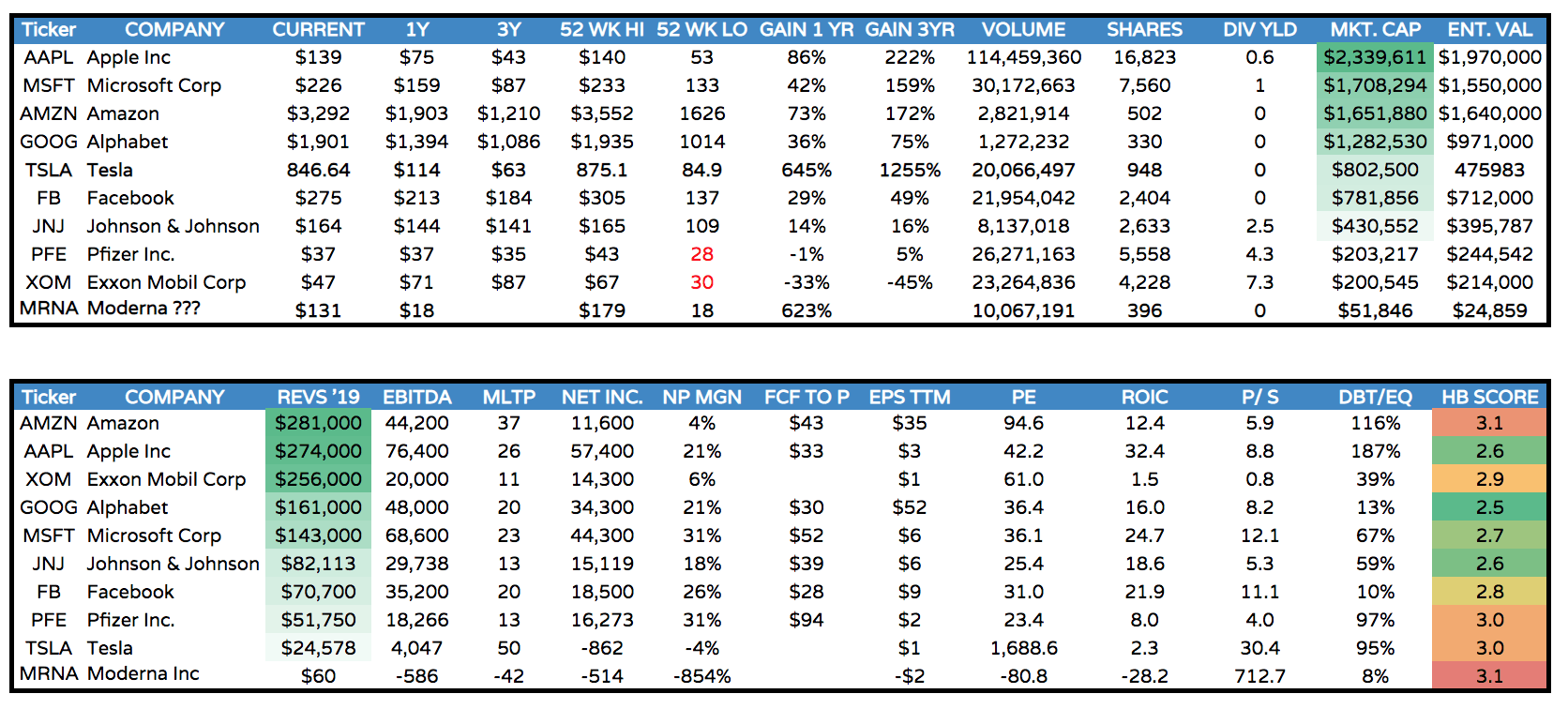

Moderna Shockingly Undervalued Can Be The First Healthcare Technology Giant Nasdaq Mrna Seeking Alpha

Wevj Free Full Text Configuration Of Electric Vehicles For Specific Applications From A Holistic Perspective Html

Minnesota Appraisal Continuing Education License Renewal Mckissock Learning

30 Simple Financial Projections Templates Free Legal Templates

Where To Find Affordable Rents Across Canada Via Zoocasa Featuring Ren One Bedroom Apartment Rent Infographic

List Of 30 Best Accounting Software For Small Businesses In 2022

Logical Functions In Excel And Or Xor And Not

Income Statement Example Template Format Income Statement Statement Template Business Template

Cade Ex991 149 Pptx Htm

Ex 99 1